Query No. 1

A. Facts of the Case

1. A company S (hereinafter referred to as the ‘company') is a public limited company listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). In the year 2009, as a part of a business transfer agreement with one of its customers N, S took over 35 employees in Germany. As a part of the business transfer agreement, S agreed to takeover customer's employees under same terms and conditions under which employees were employed immediately prior to the agreement. It was also agreed that obligations of the customer N arising from employment relationships with transferred employees shall pass to S as on the agreement date. Towards this obligation, customer N reimbursed S for an amount as agreed on the agreement date. S will be responsible for all employee related obligations on and after the agreement date. Accordingly, the pension liabilities of the employees of N were taken over by S.

2. The querist has stated that under the German law, pension is a defined benefit plan. For the purpose of pension payments and administration, N had established a fully reinsured support fund which converted defined benefit plan into contribution type defined benefit plan. With transfer of pension liabilities to S, S got admitted to the fully reinsured support fund and took over the accumulated balances of the reinsured support fund of N. The basic principles of the reinsured support fund are detailed by the querist in Annexure I.

3. In the financial year (F.Y.) 2011-12, due to changes in business scenario, the transferred employees were terminated after complying the regulatory requirements in Germany. The pension liabilities continued to be with S as they would be paid out only on death of an employee or he/she reaching retirement age, whichever is earlier. S continues to make contribution which also includes a defined annual insurance premium to the reinsured support fund and keeps the reinsurance in force - the benefits of the insurance have been supplied by the querist in Annexure I. As per the querist, this is supposed to take care of the changes in the interest rates and make the scheme similar to defined contribution scheme by taking away the effect of changes in interest rates.

4. The querist has further stated that since the employees are no longer on rolls, the pension amounts and periodic contributions are not subject to any change on account of changes in base salary (as the base salary will be the same as on the date of separation). Further, the pension liability to the employee when it becomes due will be met by the support fund. The company continues to be liable for fulfillment of pension promise, in contingent events, such as, the insurance company goes bankrupt. In the event of underfunding, the employer must pay the part of the benefit due, which cannot be paid by the support fund (because of underfunding), out of its own means. Realistically, since the support fund is fully reinsured, and till such time that a contingent event happens, and as long as the reinsurance is in force, it is unlikely that there will be underfunding. In addition to the pension promise, the company is also liable for pension adjustments to the guaranteed vested amount due to inflation. Traditionally, the inflation rate in Germany has been around 2%. However, the company expects that the increase in the guaranteed return from the contributions made to the fund, will cover the inflation costs and therefore, there is a good chance that the inflation adjustments will be met by surplus in the fund.

B. Query

5. Given this background, the querist has sought the opinion of the Expert Advisory Committee as to whether the scheme can be treated as defined contribution scheme and accordingly, whether it is appropriate for the company to consider the periodic contribution only as its expense for a given period in the financials. Reason for this being that there is a periodical payment to the support fund. This support fund will take care of the interest rate fluctuation and guarantee the payment to ex-employees on retirement or death whichever is earlier. This, as per the querist, will also eliminate the fluctuation in profit and loss account and make more sense to investors.

C. Points considered by the Committee

6. The Committee notes that the basic issue raised in the query relates to whether the pension scheme to the terminated employees in the extant case can be treated as defined contribution scheme and accordingly, whether it is appropriate for the company to consider the periodic contribution only as its expense for a given period in the financial statements. Accordingly, the Committee has considered only this issue and has not considered any other issue that may arise from the Facts of the Case, such as, accounting in the financial statements (prepared, if any) of support fund and customer N, accounting for transfer of employees by N, whether the scheme in the extant case can be considered as multi-employer plan, detailed accounting aspects of the scheme, accounting as per the German accounting principles, etc.

7. The Committee notes from the Facts of the Case that the company took over employees of its customer N as a part of business transfer agreement under the same terms and conditions under which employees were employed immediately before the agreement. Further, the obligations of N including pension liabilities arising from employment relationship were transferred to company S. Later on in F.Y. 2011-12, the transferred employees were terminated. However, the pension liability continued to be with the company. In this connection, a question may arise with regard to the nature of pension benefits. Accordingly, the Committee notes the following requirements of Accounting Standard (AS) 15, ‘Employee Benefits', notified under the Companies (Accounting Standards) Rules, 2006 (hereinafter referred to as the ‘Rules'):

The Committee notes from the Facts of the Case that the benefits to the employees are paid not due to their termination rather due to the service rendered by the employees before their termination. Therefore, the Committee is of the view that these cannot be considered as termination benefits and should be considered as post-employment benefits.

8. With regard to the type of post-employment plan, the Committee further notes the following requirements from AS 15:

The Committee notes from the Facts of the Case that although the pension liability to the employee when it becomes due will be met by the support fund, which is fully reinsured, the company continues to be liable for fulfillment of pension promise, in contingent events such as, if the insurance company goes bankrupt and in the event of underfunding. Thus, the employer, viz., the company will have to pay the part of the benefit due, which cannot be paid by the support fund (because of under funding) out of its own means. Further, in addition to the pension promise, the company is also liable for pension adjustments to the guaranteed vested amount due to inflation. Thus, although the company expects that the increase in the guaranteed return from the contributions made to the fund, will cover the inflation costs and the inflation adjustments will be met by surplus in the fund, in case surplus in the fund is not able to meet inflation adjustments, the same will be met by the company. Accordingly, the Committee is of the view that since in case of underfunding with the support fund and in case of contingency of insolvency of insurer, deficit is to be met by the employer (company S), the plan in the extant case is a defined benefit plan and not a defined contribution plan. Therefore, the company cannot treat only the periodic contributions for a period as its expenses in its financial statements.

D. Opinion

9. On the basis of the above, the Committee is of the opinion that the pension scheme in the extant case cannot be treated as defined contribution scheme and accordingly, it is not appropriate to consider the periodic contribution only as its expense for a given period in the financial statements of the company, as discussed in paragraph 8 above.

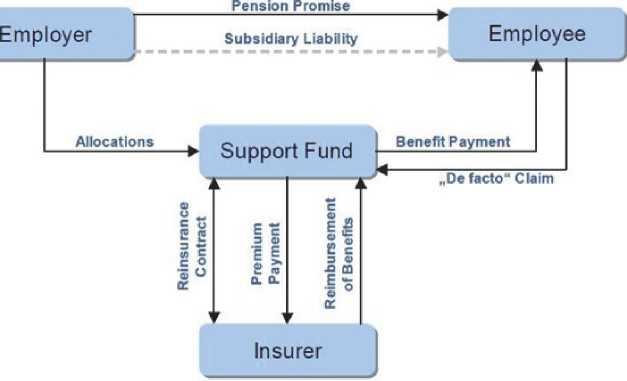

Reinsured support fund The graph below illustrates the basic principle of financing occupational pensions or lumpsum benefits by a reinsured support fund: The basic principle of a contribution-type defined benefit plan financed by a fully reinsured support fund can be briefly described as follows:

• The employer gives a pension promise in line with the support fund's benefit plan (‘Leistungsplan der Unterstutzungskasse') to the employee.

• The scope of employer contributions is commonly defined in the plan document (e.g., a fixed percentage of the employee's annual gross base salary in the particular calendar year).

• These defined contributions are paid by the employer to the support fund (‘allocations').

• The support fund takes out a life insurance (reinsurance) contract on the employee's life and as the policy-holder, is entitled to the insured benefits.

• The reinsurance premiums payable by the support fund to the life insurer are identical with the amount of employer contributions.

• According to the applicable plan provisions, the employee is entitled to benefits equal to the benefits insured under the reinsurance policy.

• Thus, defined employer contributions are actuarially converted into guaranteed minimum entitlements to benefits on the basis of a life insurance tariff. Up to the guaranteed interest rate, the insurer and - lower-ranking - the employer (due to the subsidiary liability e.g. in the event of insolvency of the insurer) bear the investment risk.

• In excess of the guaranteed interest rate, the employee bears the investment risk. However, the plan concept also offers good prospects for the employee, as dividends granted by the insurer are entirely used to increase his/her entitlement to benefits.

• After the occurrence of an event giving right to a benefit (e.g., retirement or death), the support fund receives the insured benefit plus dividends from the life insurer and, simultaneously, pays out the benefit due to the beneficiary.

• As a rule, mandatory adjustments of pensions (e.g., pre-retirement disability of the employee) in payment can be financed by the dividends granted by the insurer.

• Due to legal constraints, a support fund is not allowed to grant a legal claim to benefits. This fact, however, does not result in a potential risk or disadvantage for the employee.

• According to the German Company Pension Law, the sponsoring company (i.e., the employer) remains liable for the fulfillment of the pension promise (so called subsidiary liability). Thus, in the (unlikely) event of underfunding (e.g., insolvency), the employer must pay the part of the benefit due which cannot be paid by the support fund (because of underfunding) out of own means.

• According to the German Company Pension Act, the employer is obliged to contribute towards the statutory insolvency protection (‘Pensions-Sicherungs-Verein') of the Government of Germany, even if the support fund takes out congruent reinsurance. The insolvency protection insurance covers the risk of insolvency of the Government of Germany.

• As per German tax and accounting standards, corporates/listed companies in Germany are not required to account for such pension assets and obligations as assets and liabilities in their balance sheet. Instead, a mere disclosure in notes to accounts of any deficits (i.e., pension obligations minus support fund's assets) is sufficient, given that the support fund has claim to benefits under the re-insurance contract to cover the defined benefit obligations to the employees. ___________ 1Opinion finalised by the Committee on 23.4.2015. |